SARFAESI Recovery in FY2024: Key Trends, Insights, Challenges in Asset Resolution

The SARFAESI Act (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act) remains a cornerstone for resolving distressed assets in India. SARFAESI Recovery in FY 2024 has been particularly noteworthy, with significant growth in cases and amounts involved under the Act.

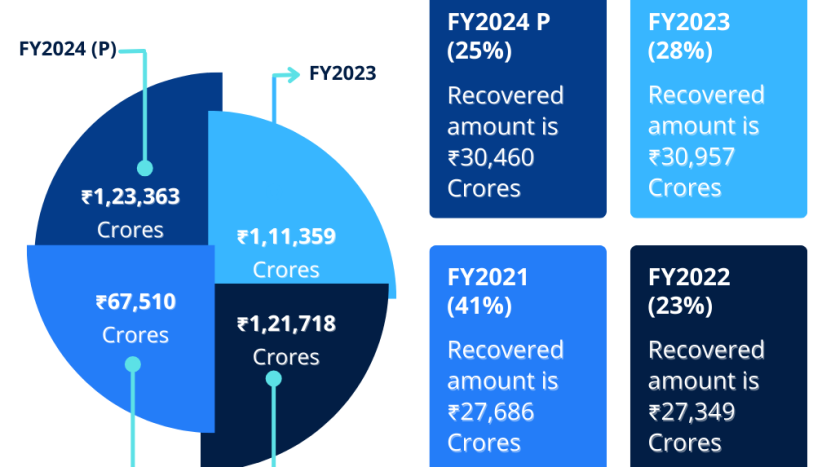

Here’s a snapshot of the SARFAESI recovery statistics for FY2024:

- Total Amount Recovered: ₹30,460 crore

- Recovery Rate: 24.7%

- Total Amount Involved: ₹1,23,363 crore

- Number of Cases Referred: 2,31,407 (a 24% increase from FY23)

📅 Yearly Trends: Amount Involved and Recovery

From FY20 to FY24, the SARFAESI Act facilitated the resolution of ₹6,20,532 crore worth of assets, achieving a total recovery of ₹1,50,735 crore. While the overall recovery rate stands at 24%, annual fluctuations in the amount involved highlight shifting trends in the asset resolution landscape:

| Year | Amount Involved (₹ Crore) |

|---|---|

| 2020 | 1,96,582 |

| 2021 | 67,510 |

| 2022 | 1,21,718 |

| 2023 | 1,11,359 |

| 2024 | 1,23,363 |

📈 Key Trends in FY2024

1️⃣ Surge in SARFAESI Cases

- The total number of cases referred under SARFAESI rose from 1,87,340 in FY23 to 2,31,407 in FY24, marking a significant 24% increase.

- This rebound follows a decline of 24.6% in 2022-23, underscoring renewed confidence in the SARFAESI mechanism.

2️⃣ Decline in Other Resolution Channels

- Other resolution frameworks witnessed a drop in referred cases, highlighting SARFAESI’s growing prominence.

3️⃣ Asset Sales to GNPA Ratio Drops

- The ratio of asset sales to gross non-performing assets (GNPAs) fell to 5.8% in FY24, compared to 9.7% in FY23, indicating the need for more robust asset management strategies.

💡 Challenges and Opportunities

Despite its effectiveness, the SARFAESI Act has room for improvement in terms of recovery efficiency. Key challenges include:

- Delays in the Auction Process: Timely execution of auctions is critical to preventing asset value erosion.

- Resistance from Borrowers: Legal disputes initiated by borrowers often prolong resolution timelines.

- Low Recovery Rates: With a recovery rate of 24%, there is potential to optimize processes and policies for better outcomes.

🔑 Strategies to Enhance SARFAESI Recovery

To improve the efficiency of SARFAESI-led recoveries, the following measures can be implemented:

- Leveraging Technology: Digital platforms for transparent and faster auctions can reduce delays and boost participation.

- Streamlining Legal Processes: Simplified legal frameworks can minimize borrower resistance and expedite asset resolution.

- Collaboration with ARCs: Asset Reconstruction Companies (ARCs) can play a pivotal role in managing and disposing of distressed assets effectively.

🗓 The Road Ahead for SARFAESI

The growing reliance on the SARFAESI Act for asset resolution emphasizes its importance in India’s financial ecosystem. However, to maintain its relevance and effectiveness, continuous improvement in processes and policies is essential.

🏦 SARFAESI: A Pillar of Asset Resolution

The financial year 2023-24 has highlighted both the strengths and challenges of the SARFAESI Act. With ₹30,460 crore recovered and over 2.31 lakh cases referred, SARFAESI remains a critical tool in addressing NPAs. By leveraging technology and refining processes, stakeholders can unlock the full potential of this powerful framework.

What are your thoughts on improving recovery rates under SARFAESI? Share your insights in the comments below! 👇