SARFAESI Act: A Comprehensive Guide to NPA Recovery

Understanding the SARFAESI Act: A Comprehensive Guide to NPA Recovery by Banks in India

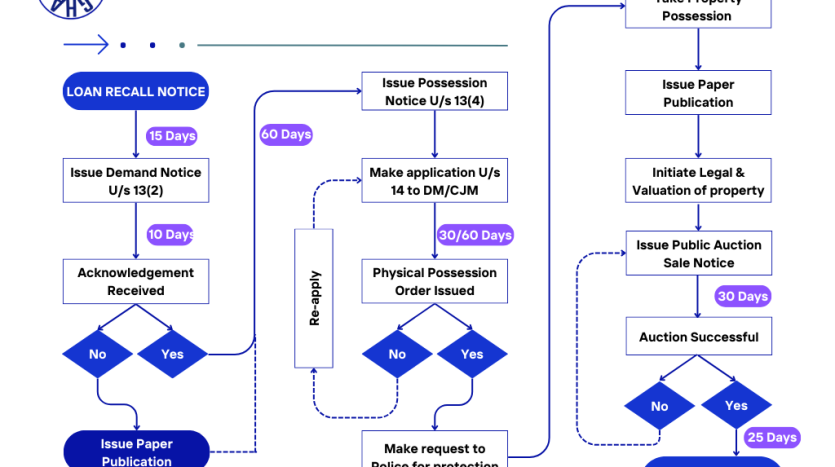

The SARFAESI Act, introduced in December 2002, was designed to empower lenders in India to recover dues swiftly and efficiently. This Act allows banks and financial institutions to repossess mortgaged properties, conduct auction sales, and recover outstanding debts, following a structured and transparent process.

Key Provisions of the SARFAESI Act

- Issuance of Demand Notice (Section 13(2)):

The recovery process begins with the issuance of a Demand Notice under Section 13(2). This notice requires borrowers to clear their dues within 60 days from the date of receipt. Lenders must send these notices via Registered Post Acknowledgement Due (RPAD) and also make public announcements through newspaper publications and notices pasted on the mortgaged property. - Symbolic Possession (Section 13(4)):

If the borrower fails to respond to the demand notice or repay the dues, the lender can initiate Symbolic Possession by issuing a notice under Section 13(4). This notice informs the borrower and the public about the lender’s intent to take over the property symbolically. Although not mandatory, this step is common practice to maintain transparency. - Physical Possession via CMM/DM (Section 14):

When borrowers resist repossession, banks can file an application under Section 14 with the Chief Metropolitan Magistrate (CMM) or District Magistrate (DM) to secure physical possession of the property. The CMM/DM facilitates the handover to the lender’s Authorised Officer, ensuring compliance with legal procedures. - Auction Sale of the Secured Asset:

Once possession is obtained, the secured property is sold through a public auction. Banks must advertise auction details, including property specifications, reserve price, date, time, and venue, in at least two newspapers to ensure maximum participation. - Borrower’s Right to Redeem (Section 13(8)):

Borrowers retain the right to reclaim the property before the auction by settling the dues, including costs, charges, and expenses incurred by the lender. If the outstanding amount is paid in full before the auction date, the lender cannot proceed with the sale or transfer of the property. - Borrower’s Recourse to DRT (Section 17(1)):

Borrowers can challenge the lender’s actions under Section 13(4) by filing an application with the Debt Recovery Tribunal (DRT). If the DRT finds that the lender’s actions violated the provisions of the SARFAESI Act, it may declare the repossession invalid and order the restoration of the property to the borrower.

Transparency and Compliance

All actions under the SARFAESI Act must be carried out by the Authorised Officer appointed by the lender. Each step, from demand notice issuance to auction sale, follows a well-defined process to ensure transparency and protect the rights of both lenders and borrowers.

Conclusion

The SARFAESI Act serves as a critical tool for lenders to recover non-performing assets (NPAs) while offering borrowers avenues for relief through fair legal processes. Understanding the structured steps of this Act can help borrowers and lenders navigate property recovery efficiently.