NPA Recovery in India Explained: Why SARFAESI and IBC Deliver Better Outcomes

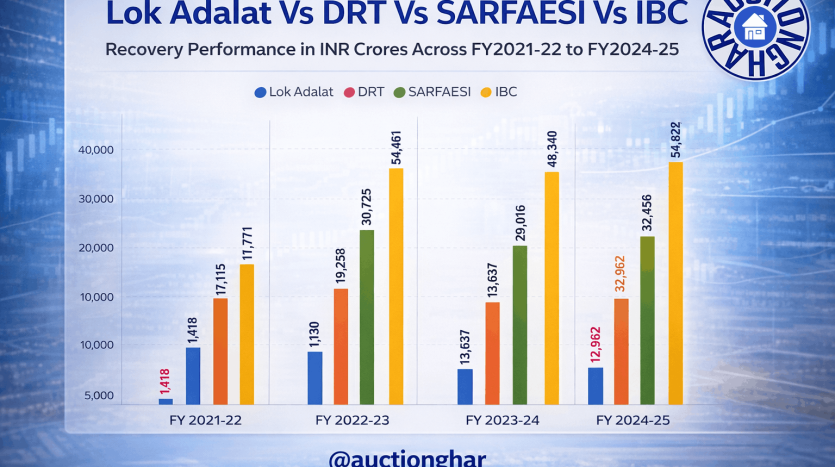

Not All NPA Recovery Mechanisms Are Equal: What FY 2021–22 to FY 2024–25 Data Really Tells Us

For decades, India’s banking system has relied on multiple legal and institutional mechanisms to resolve Non-Performing Assets (NPAs). From Lok Adalat and Debt Recovery Tribunals (DRT) to SARFAESI and the Insolvency and Bankruptcy Code (IBC), each framework was designed with a specific objective.

But when we step back and analyze recovery trends from FY 2021–22 to FY 2024–25, a clear and compelling insight emerges:

👉 Not all recovery mechanisms are created equal.

The difference is not just legal—it’s strategic, financial, and deeply linked to value realization.

Lok Adalat: Clearing Volumes, Not Value

Lok Adalat plays an important but narrowly defined role in India’s NPA ecosystem. Its strength lies in speed and settlement, especially for small-ticket loans and early-stage NPAs.

However, expecting Lok Adalat to materially clean up bank balance sheets is unrealistic.

The data confirms this reality:

-

High case volumes

-

Low average recovery per account

-

Best suited for compromise settlements, not value maximization

Lok Adalat works when the objective is pipeline hygiene, not when banks are chasing meaningful recovery values.

DRT: A System Under Strain

Once considered the backbone of institutional NPA recovery, Debt Recovery Tribunals now tell a more complex story.

A sharp spike in recoveries during one year—followed by a noticeable decline—signals deeper structural issues:

-

Capacity constraints

-

Procedural delays

-

Prolonged litigation cycles

While recovery through DRT remains legally possible, it is increasingly unpredictable. For banks, DRT is no longer a default option—it is a selective tool that must be used judiciously.

SARFAESI: Quiet, Consistent, and Reliable

Among all recovery mechanisms, SARFAESI stands out for one reason—consistency.

Year after year, SARFAESI delivers:

-

Stable recovery values

-

Low volatility

-

Strong outcomes in retail and MSME lending

This reliability stems from asset-backed enforcement. When security is enforceable and execution is disciplined, SARFAESI auctions remain one of the most dependable recovery tools available to Indian banks.

At Auction Ghar, this is precisely why bank auction properties under SARFAESI continue to attract serious end-users and investors.

IBC: More Than Recovery—A Market Signal

The Insolvency and Bankruptcy Code (IBC) is not just another recovery channel.

It is a signal to the market.

What the data shows clearly:

-

Higher average recovery values

-

Sustained momentum

-

Rising investor and institutional participation

IBC has evolved from an experimental framework into India’s primary value-discovery mechanism. It enforces discipline, improves transparency, and attracts capital—making it the preferred route for large, stressed, and complex assets.

The Real Insight: Strategic Sequencing, Not Selection

The key takeaway isn’t about choosing one recovery mechanism over another.

It’s about strategic sequencing:

▶️ Use Lok Adalat to clean the pipeline

▶️ Use DRT selectively, not reflexively

▶️ Use SARFAESI to enforce security decisively

▶️ Use IBC to unlock value and attract capital

In today’s financial environment, NPA recovery is no longer just a legal process.

It is a capital allocation decision.

Why This Matters for Banks, Investors, and Buyers

Institutions that understand this shift will:

-

Improve recovery efficiency

-

Reduce time-to-resolution

-

Attract stronger investor participation

-

Accelerate balance sheet clean-up

Platforms like Auction Ghar play a critical role in this ecosystem by enabling transparent, tech-driven access to bank auction and distressed properties, ensuring that recovery mechanisms translate into real market outcomes.

The Bottom Line

India’s next phase of financial clean-up will not be driven by litigation alone—but by data-backed strategy, disciplined execution, and market participation.

The institutions that recognize this will lead.

The rest will follow.

🔔 Follow Auction Ghar for insights on NPA recovery, SARFAESI auctions, distressed asset investing, and India’s evolving resolution landscape.