Understanding Loan Write-Offs: Myths vs. Reality

Loan write-offs are often shrouded in misconceptions, with many perceiving them as a “debt waiver.” However, they play a unique and essential role in the financial ecosystem. 📊 Here’s the truth—historically, banks recover minimal amounts from written-off accounts. But what does this process entail, and why does it matter? Let’s break it down.

🔍 What is a Loan Write-Off?

A loan is classified as a Non-Performing Asset (NPA) or bad loan when a borrower fails to repay it for three consecutive months. At this stage, banks may opt to write off the loan.

But what does this mean? Writing off a loan doesn’t mean the borrower is off the hook; it’s an accounting action aimed at financial clarity.

📚 Why Do Banks Write Off Loans?

Banks undertake loan write-offs for several critical reasons:

1️⃣ Balance Sheet Cleanup

Removing bad loans from the books enables banks to present a cleaner and healthier financial statement, essential for maintaining investor confidence.

2️⃣ Record Maintenance

Even after a loan is written off, banks retain records of the unpaid debt, keeping the possibility of future recovery alive.

3️⃣ Regulatory Compliance

Writing off irrecoverable loans helps banks adhere to regulatory guidelines while recalibrating their risk management strategies.

💡 Does Write-Off Mean Waiver?

Absolutely not! Loan write-offs are often misconstrued as a complete waiver of debt, but the reality is different.

- Write-Off: An accounting adjustment where the unrecovered amount is removed from the bank’s books.

- Waiver: A formal cancellation of the borrower’s debt obligations.

Banks can still pursue recovery actions on written-off loans, but these amounts no longer impact the bank’s net NPAs or gross income calculations.

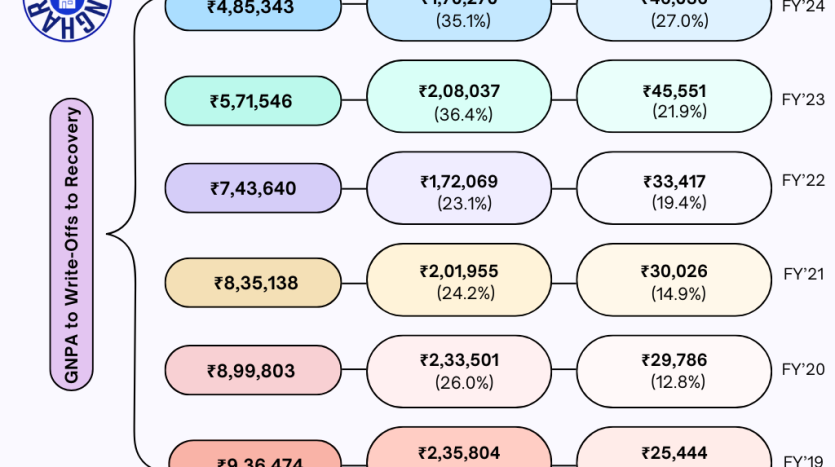

👉 The Reality Check

While the write-off process streamlines bank accounts, the recovery of written-off loans remains a challenge. The dismal recovery rates highlight inefficiencies in current debt recovery mechanisms and underscore the need for robust solutions.

🔗 Join the Conversation

How can banks enhance their recovery rates while effectively managing NPAs? Share your insights and ideas in the comments below! 💬

Let’s work toward creating a more transparent and effective financial system.

For more insights into banking and NPA management, follow our blog at Auction Ghar!