India’s Home Loan Portfolio Growth vs Risk: What Delinquency Trends Reveal (Mar 2021–Mar 2025)

India’s Home Loan Portfolio Growth vs Risk: What the Data Really Shows

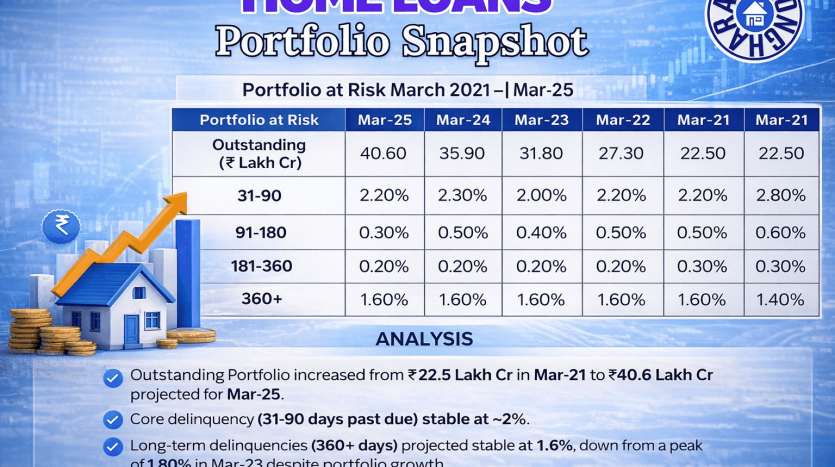

India’s home loan market continues to expand at an impressive pace, driven by urbanization, policy support, and sustained housing demand. However, the real story is not just about scale—it’s about portfolio quality, delinquency behavior, and risk discipline.

A closer look at CRIF Highmark data from March 2021 to March 2025 reveals a critical insight: growth has been accompanied by control, not deterioration.

📊 Home Loan Portfolio Snapshot (Mar’21 → Mar’25)

🔹 Outstanding Portfolio Growth

-

Home loan outstanding nearly doubled from ₹22.5 lakh crore to ₹40.6 lakh crore

-

Reflects strong demand across salaried, self-employed, and emerging borrower segments

🔹 31–90 DPD: Early Delinquency Under Control

-

31–90 days past due (DPD) remains range-bound at around 2%

-

Indicates effective early risk detection and underwriting discipline

🔹 91–180 & 181–360 DPD: Slippages Well Contained

-

Despite sharp portfolio expansion, mid-stage delinquency buckets remain stable

-

Suggests proactive collections and borrower engagement

🔹 360+ DPD: Deep NPAs Stabilizing

-

360+ DPD stabilized at 1.6%, improving from the Mar’23 peak of 1.8%

-

Confirms resilience even under macro stress conditions

🔍 What These Home Loan Delinquency Trends Tell Us

✅ Better Underwriting Is Driving Safer Growth

Growth is no longer fuelled by aggressive disbursement alone. Lenders are investing in:

-

Data-led borrower profiling

-

Income stability and repayment behavior analytics

-

Credit bureau–driven risk filters

✅ Early Warning Systems Are Preventing NPAs

Technology-enabled monitoring allows lenders to:

-

Identify stress early

-

Intervene before accounts slip into deep delinquency

-

Reduce long-term NPA formation

✅ Housing Finance Remains a Resilient Asset Class

Among all retail loan segments, home loans continue to demonstrate superior asset quality, making them a preferred choice for banks and housing finance companies.

🏦 Why Risk Discipline Is the New Growth Lever

As loan books scale, risk management—not disbursement velocity—becomes the real differentiator.

Institutions that prioritize:

-

Digital underwriting

-

Tech-enabled collections

-

Faster recovery and resolution mechanisms

will continue to outperform across cycles.

🔚 The Bottom Line

For banks, NBFCs, and fintech lenders, the message is clear:

👉 Sustainable growth is built on portfolio hygiene, not just balance sheet expansion.

India’s home loan segment proves that when growth is backed by discipline, resilience follows.

📌 Source: CRIF Highmark